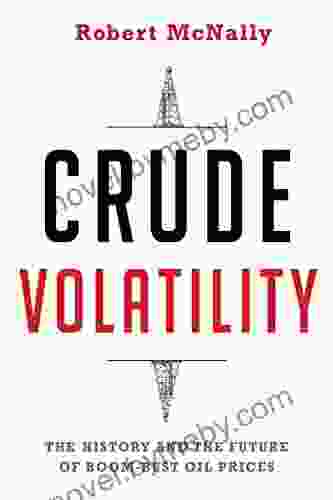

The History and Future of Boom Bust Oil Prices: Centered on Global Energy

The history of oil prices is a story of boom and bust cycles. Prices have soared to record highs, only to crash down to lows, time and time again. This volatility has had a major impact on the global economy, and it is likely to continue to do so for many years to come.

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

There are a number of factors that have contributed to the boom bust cycle in oil prices. One factor is the global supply and demand balance. When demand for oil exceeds supply, prices tend to rise. Conversely, when supply exceeds demand, prices tend to fall.

Another factor that has contributed to the boom bust cycle is the role of OPEC. OPEC is a cartel of oil-producing countries that controls a large share of the global oil market. OPEC has often used its power to influence oil prices, by restricting or increasing production.

Finally, the global economy also plays a role in the boom bust cycle. When the global economy is growing, demand for oil tends to rise. Conversely, when the global economy is contracting, demand for oil tends to fall.

The boom bust cycle in oil prices is likely to continue for many years to come. There are a number of factors that will continue to drive volatility, including the global supply and demand balance, the role of OPEC, and the global economy.

In the short term, oil prices are likely to remain volatile. The global economy is slowing down, and this is likely to reduce demand for oil. However, there are also a number of factors that could push prices higher, such as geopolitical tensions and natural disasters.

In the long term, the future of oil prices is uncertain. There are a number of factors that could lead to lower prices, such as the development of new technologies and the transition to renewable energy. However, there are also a number of factors that could lead to higher prices, such as the growing demand for oil from emerging markets.

The boom bust cycle in oil prices is a complex issue with no easy answers. However, by understanding the factors that have contributed to the cycle in the past, we can better prepare for the future.

The Impact of Boom Bust Oil Prices

The boom bust cycle in oil prices has a major impact on the global economy. When oil prices are high, it can lead to inflation, economic growth, and political instability. When oil prices are low, it can lead to deflation, economic recession, and social unrest.

The impact of oil prices is particularly pronounced in developing countries. These countries are often heavily dependent on oil exports, and they are therefore vulnerable to fluctuations in oil prices. When oil prices are high, these countries can experience economic growth and prosperity. However, when oil prices are low, these countries can experience economic hardship and poverty.

The boom bust cycle in oil prices also has a major impact on the environment. When oil prices are high, it encourages the development of new oil fields and the use of more expensive and environmentally damaging extraction methods. When oil prices are low, it discourages the development of new oil fields and the use of more expensive and environmentally damaging extraction methods.

The boom bust cycle in oil prices is a complex issue with no easy answers. However, by understanding the factors that have contributed to the cycle in the past, we can better prepare for the future.

The Future of Oil Prices

The future of oil prices is uncertain. There are a number of factors that could lead to lower prices, such as the development of new technologies and the transition to renewable energy. However, there are also a number of factors that could lead to higher prices, such as the growing demand for oil from emerging markets.

One of the most important factors that will affect the future of oil prices is the development of new technologies. New technologies, such as fracking and horizontal drilling, have made it possible to extract oil from previously inaccessible areas. This has led to a glut of oil on the market, which has put downward pressure on prices.

Another important factor that will affect the future of oil prices is the transition to renewable energy. Renewable energy sources, such as solar and wind power, are becoming increasingly affordable and efficient. This is leading to a decline in the demand for oil, which is also putting downward pressure on prices.

However, there are also a number of factors that could lead to higher oil prices in the future. One factor is the growing demand for oil from emerging markets. As these countries develop, they are consuming more and more oil. This is putting upward pressure on prices.

Another factor that could lead to higher oil prices is geopolitical tensions. Tensions between oil-producing countries, such as Saudi Arabia and Iran, can disrupt the flow of oil to the market. This can lead to higher prices.

Finally, natural disasters, such as hurricanes and earthquakes, can also disrupt the flow of oil to the market. This can also lead to higher prices.

The future of oil prices is uncertain. There are a number of factors that could lead to lower prices, such as the development of new technologies and the transition to renewable energy. However, there are also a number of factors that could lead to higher prices, such as the growing demand for oil from emerging markets, geopolitical tensions, and natural disasters.

The history and future of boom bust oil prices is a complex issue with no easy answers. However, by understanding the factors that have contributed to the cycle in the past, we can better prepare for the future.

The boom bust cycle in oil prices is likely to continue for many years to come. However, there are a number of factors that could lead to lower prices, such as the development of new technologies and the transition to renewable energy. However, there are also a number of factors that could lead to higher prices, such as the growing demand for oil from emerging markets, geopolitical tensions, and natural disasters.

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Priscilla Gilman

Priscilla Gilman Stephen C Doyle

Stephen C Doyle Sophie Kulinski

Sophie Kulinski Priscilla Kohutek

Priscilla Kohutek Liz Brown

Liz Brown Quinn Kingston

Quinn Kingston Roy Barth

Roy Barth Torkel Klingberg

Torkel Klingberg Rolf Giesen

Rolf Giesen Ruby Boukabou

Ruby Boukabou Philip D Anieri

Philip D Anieri Ken Light

Ken Light Steven Horak

Steven Horak Rob Sinclair

Rob Sinclair Rob Sheffield

Rob Sheffield Priscilla Short

Priscilla Short Randy Shilts

Randy Shilts Thomas J Peters

Thomas J Peters Uday Singh Mehta

Uday Singh Mehta Ron Rapoport

Ron Rapoport

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Shane BlairThe Story of an Outside-the-Box Kid and the Mom Who Loved Him: A Journey of...

Shane BlairThe Story of an Outside-the-Box Kid and the Mom Who Loved Him: A Journey of...

Fernando PessoaMaking Decisions In Pregnancy And Childbirth: Empowering Expectant Mothers...

Fernando PessoaMaking Decisions In Pregnancy And Childbirth: Empowering Expectant Mothers...

David PetersonThe Island Hopping Digital Guide To The Exuma Cays Part III: The Central...

David PetersonThe Island Hopping Digital Guide To The Exuma Cays Part III: The Central... Joe SimmonsFollow ·17.4k

Joe SimmonsFollow ·17.4k Walt WhitmanFollow ·3.5k

Walt WhitmanFollow ·3.5k Ira CoxFollow ·6.2k

Ira CoxFollow ·6.2k Anthony BurgessFollow ·8.4k

Anthony BurgessFollow ·8.4k Jared PowellFollow ·11.9k

Jared PowellFollow ·11.9k Thomas MannFollow ·15.9k

Thomas MannFollow ·15.9k Guy PowellFollow ·5.9k

Guy PowellFollow ·5.9k Pablo NerudaFollow ·2.1k

Pablo NerudaFollow ·2.1k

Mike Hayes

Mike HayesArthur Meighen: A Life in Politics

Arthur Meighen was one of Canada's most...

Bryan Gray

Bryan GrayVindicated: Atlanta's Finest

In the heart of Atlanta, a...

Houston Powell

Houston PowellHis to Defend: A Captivating Legal Thriller That Will...

An Unforgettable...

John Green

John GreenUncover the Riveting Tale of "Hunted: Atlanta Finest" - A...

Prepare yourself for a...

4.6 out of 5

| Language | : | English |

| File size | : | 1472 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |